Tax time and business health reports keep you informed and tax-time readyĪutomatically track your mileage and never miss a mileage deduction again Reports and tools to track money in and out, so you know where you standĮasily log expenses and receipts to ensure your books are always tax-time ready Quick and easy online, recurring, and invoice-free payment optionsĪutomated, to accurately track time and easily log billable hours

SELLING GENERAL AND ADMINISTRATIVE EXPENSES PROFESSIONAL

Please verify with scheme information document before making any investment.Wow clients with professional invoices that take seconds to create However, no guarantees are made regarding correctness of data. Disclaimer:Īll efforts have been made to ensure the information provided here is accurate. They tend to be highly fixed in comparison to the selling costs in SGA. G&A costs tend to incur in the daily operations of the business and might not be responsible for being linked directly with any specific department or function of the organization. These are the expenses that an organization is expected to incur for opening its operations on a day-to-day Basis. These expenses are the ones that serve to the overhead of the organization. G&A or General & Administrative Expenses in SGA Indirect selling costs are expenses occurring across the entire manufacturing process –after the product has been finished.

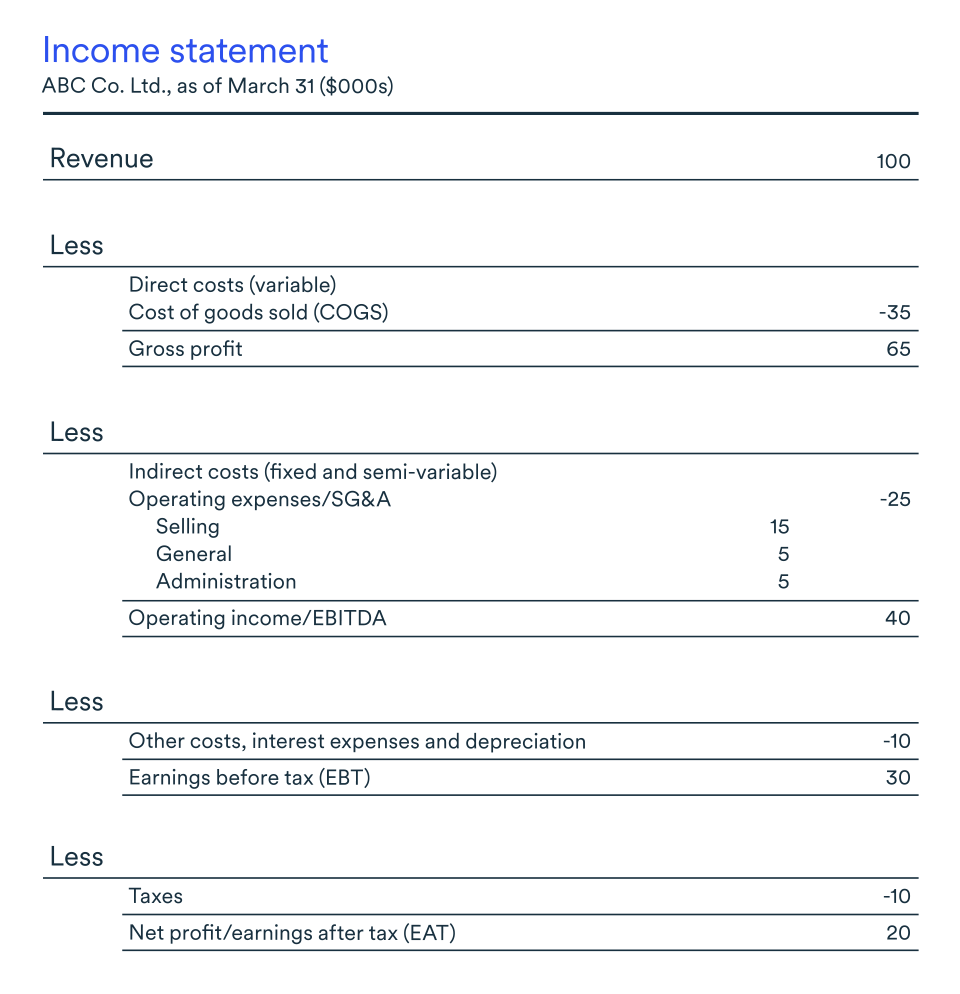

Direct selling costs tend to occur only when the product gets sold while including factors like shipping supplies, sales commissions, and delivery charges. These expenses can be subdivided into direct as well as indirect costs in association with the selling process of some product. Moreover, research & development expenses are also not included in the SGA. It serves to have its own line on the given income statement. Interest expense turns out to be one of the major expenses that are not included in the concept of SGA. When the overall expenses get deducted from the respective gross margin, it results in the delivery of net income. Below the value of gross margin, SGA, along with other expenses, gets listed. In the given income statement, COGS gets deducted from the figure of net revenue for determining the overall gross margin. SGA comprises of everything that will not be included in the COGS or Cost of Goods Sold.

Additionally, utilities, rent, and supplies that do not remain a part of the production process tend to be included within SGA. It is also known to include the concept of advertising, commissions, and any other promotional material. This is known to include the salaries of staff of different departments including human resources, IT, marketing, and so more. SGA is not known to be assigned to production costs as it will be dealing with all other aspects that are related to the creation of some product. This implies that SGA is known to include the overall costs of producing and selling products as well as services along with the costs of managing the company. It is known to comprise all expenses that are not directly linked to Manufacturing some product or delivering some service. Selling, General & Administrative Expense (SG&A) Updated on Septem, 377 viewsĪs per the Selling, General & Administrative Expense (SG&A) definition, it is known to be claimed on the respective Income statement to serve as the total of entire direct as well as indirect selling costs along with all G&A (General & Administrative) expenses of some organization.

0 kommentar(er)

0 kommentar(er)